AMD Announces FY 2015 Q3 Results: Decreased Computing And Graphics Sales Hurt Bottom Line

Today AMD has announced their third quarter earnings for fiscal year 2015. AMD saw a 13% increase in revenue over Q2 2015, but revenues were down almost 26% over their Q3 2014 numbers. Revenue for the quarter was $1.06 billion USD, down from $1.43 billion a year ago. AMD continues to use GAAP and Non-GAAP earnings to help show the state of the business in greater detail. On a GAAP basis, AMD had an operating loss of $158 million for the quarter, and a $197 million net loss, which works out to $0.25 per share. Compared to last quarter, both losses were larger despite the increased revenue, and the numbers are down significantly over the $17 million net income a year ago.

| AMD Q3 2015 Financial Results (GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | |||

| Revenue | $1.06B | $942M | $1.43B | ||

| Gross Margin | 23% | 25% | 35% | ||

| Operating Income | -$158M | -$137M | $63M | ||

| Net Income | -$197M | -$181M | $17M | ||

| Earnings Per Share | -$0.25 | -$0.23 | $0.02 | ||

On a Non-GAAP basis, AMD had a $97 million operating loss, which is once again a larger loss than last quarter, and down 211% from the $87 million in operating income last year. Net loss was $136 million, or $0.17 per share, compared to a $41 million net profit and $0.05 per share last year. GAAP to Non-GAAP differences are due to $48 million in restructuring fees and $13 million in stock based compensation.

| AMD Q3 2015 Financial Results (Non-GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | |||

| Revenue | $1.06B | $942M | $1.43B | ||

| Gross Margin | 23% | 28% | 35% | ||

| Operating Income | -$97M | -$87M | $87M | ||

| Net Income | -$136M | -$131M | $41M | ||

| Earnings Per Share | -$0.17 | -$0.17 | $0.05 | ||

The Computing and Graphics segment continues to struggle, although AMD did see stronger sequential growth here with the recent launch of Carrizo. Revenue increased 12% over last quarter, although it is still down 46% year-over-year. This segment had an operating loss of $181 million for the quarter, up from a loss of $147 million last quarter and a loss of $17 million a year ago. Sequentially, the loss is mostly attributed to a write-down of $65 million which AMD is taking on older-generation products. Annually, the decrease is due to lower overall sales. Unlike Intel, AMD processors had a decrease in Average Selling Price (ASP) both sequentially and year-over-year, so there was no help there from the lower sales volume. The GPU ASP was a different story, staying flat sequentially and increasing year-over-year. Recent launches of new AMD graphics cards have helped here.

| AMD Q3 2015 Computing and Graphics | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | |||

| Revenue | $424M | $379M | $781M | ||

| Operating Income | -$181M | -$147M | -$17M | ||

The Enterprise, Embedded, and Semi-Custom segment had a better showing. Revenue increased 13% over last quarter, and was down only 2% year-over-year. Semi-custom sales (read Consoles) drove the sequential increase but lower embedded and server processor sales caused a year-over-year decline. Operating income for this segment came in at $84 million, up from $27 million in Q2 but down from $108 million in Q3 2014. Q2’s numbers were skewed though by a $33 million hit on moving to a new process node.

| AMD Q3 2015 Enterprise, Embedded and Semi-Custom | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | |||

| Revenue | $637M | $563M | $648M | ||

| Operating Income | $84M | $27M | $108M | ||

All Other had an operating loss of $61 million for the quarter, up from $17 million loss in Q2 and a $28 million loss in Q3 2014. This is where they stick their “restructuring charges” and they nicely align with the GAAP vs Non-GAAP values.

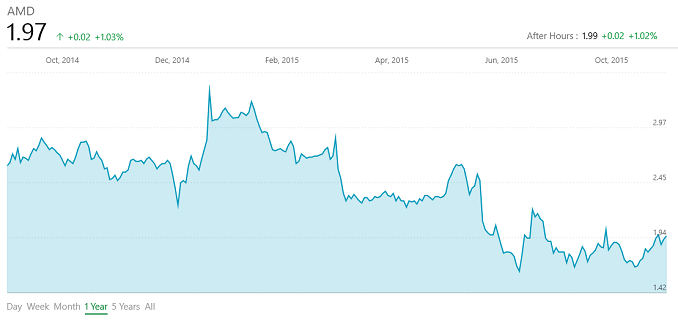

The bad news doesn’t stop here either. We’ve seen the departure of a couple of key people at AMD, and AMD is also spinning off some of the company. Revenues for Q4 are expected to decrease an additional 10%, plus or minus 3%, compared to today’s numbers. AMD is doing more corporate restructuring in an attempt to reduce expenses further. Perhaps the most troubling aspect of today’s results is their gross margin is only 23%. They really need closer to 35% for profitability and are a long way from that today.

Source: AMD Investor Relations