NVIDIA Announces Earnings for Q1 FY 2018

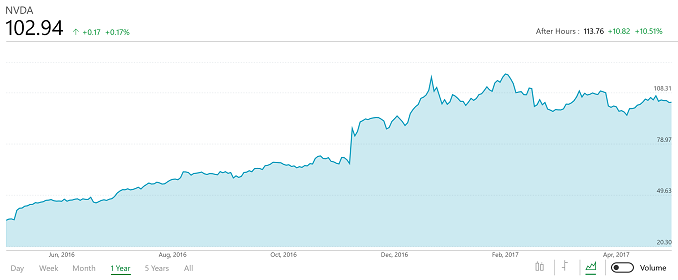

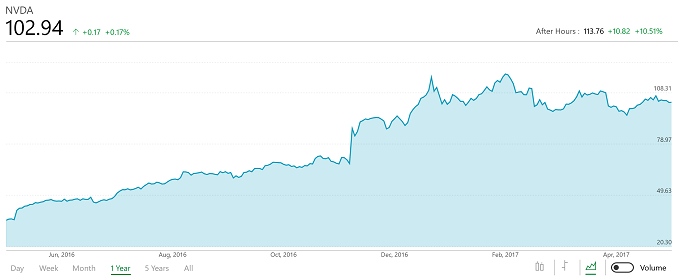

This afternoon, NVIDIA announced their earnings for the first quarter of their 2018 fiscal year. NVIDIA has been having a lot of success moving their core GPU business away from just PC gaming, and into far more categories, and the earnings today suggest that they’ve made some excellent strategic moves, coupled with solid product launches. Revenue for the quarter came in at $1.94 billion, which is an increase of 48% from Q1 2017. Gross margin was up 1.9% from a year ago, with 59.4% for the quarter. Operating income was up a staggering 126% to $554 million, and net income was up 144% to $507 million. This resulted in earnings per share of $0.79, up 126% from a year ago when they were $0.35. Last year, NVIDIA had record revenues, and this fiscal year they are off to an even better start.

| NVIDIA Q1 2018 Financial Results (GAAP) | |||||

| Q1'2018 | Q4'2017 | Q1'2017 | Q/Q | Y/Y | |

| Revenue (in millions USD) | $1937 | $2173 | $1305 | -11% | +48% |

| Gross Margin | 59.4% | 60.0% | 57.5% | -0.6% | +1.9% |

| Operating Income (in millions USD) | $554 | $733 | $245 | -24% | +126% |

| Net Income | $507 | $655 | $208 | -23% | +144% |

| EPS | $0.79 | $0.99 | $0.35 | -20% | +126% |

Despite NVIDIA diversifying, and creating new markets for their GPUs, gaming is still the core of the company. They have come a long way in some of their segments, but gaming still accounts for 53% of their revenue, meaning it is larger than every other segment combined. Interestingly, despite the high gains in practically all other segments, the growth in gaming was higher. Last year at the end of Q1 2017, gaming accounted for only 52.6% of their revenue. For this quarter, revenue from gaming was $1.027 billion, compared to $687 million a year ago. A strong year of Pascal under their belt, and the launch of the GeForce GTX 1080 Ti, shows that there’s still room for growth in the PC market.

Professional Visualization, which is the segment for Quadro, had much lower growth than GeForce, but still increased revenues from $189 million a year ago, to $205 million today. That’s reasonable growth of 8.4%, but compared to pretty much every other NVIDIA segment, it seems like it’s not growing at all.

Datacenter is where NVIDIA has really found a great home for their GPU business, especially with the growth in machine learning and AI. NVIDIA’s Tesla business was once an afterthought for the company (well, maybe not the company, but outsiders looking in), but with the launch of the Tesla P100 and smaller variants, and DGX-1, NVIDIA has found some big customers for their datacenter compute products, including Microsoft, Google, and several other cloud vendors. Datacenter revenue was up 186% to $409 million. To put that in perspective, NVIDIA didn’t even discuss datacenter revenues even two years ago, and it’s now their second largest business. Not only that, it’s very likely one of their highest margin businesses as well.

Automotive, which came out of the failed Tegra smartphone and tablet business, is still showing strong growth as well. There’s a great saying about making lemonade, and NVIDIA has certainly done that. Revenue for this segment was up almost 24% to $140 million for the quarter.

Finally, OEM and IP is the only segment to have a falling quarter, with revenues down about 10% to $156 million.

| NVIDIA Quarterly Revenue Comparison (GAAP) | |||||

| In millions | Q1'2018 | Q4'2017 | Q1'2017 | Q/Q | Y/Y |

| Gaming | $1027 | $1348 | $687 | -23.8% | +49.5% |

| Professional Visualization | $205 | $225 | $189 | -8.9% | +8.5% |

| Datacenter | $409 | $296 | $143 | +38.2% | +186% |

| Automotive | $140 | $113 | $93 | +23.9% | +50.5% |

| OEM & IP | $156 | $176 | $173 | -11.4 | -9.8% |

NVIDIA has followed up strong product launches with solid diversification of their core business, and the results speak for themselves. The last couple of years have been very strong, and it appears that growth is going to continue for at least the near term. NVIDIA is expecting revenues for next quarter to be $1.95 billion, plus or minus 2%, with a gross margin of 58.4% plus or minus 0.5%.

Source: NVIDIA Investor Relations