Qualcomm Announces Major Workforce Restructuring With Q3 FY 2015 Results

At one point, it seemed like Qualcomm would become the ARM equivalent to Intel in the x86 space. Their Snapdragon processors, equipped with industry leading cellular technology, powered a huge number of devices. Practically every flagship phone of 2013 and 2014 (sans Apple of course) carried a Qualcomm processor inside. But even Intel makes some big missteps, and the Netburst era was certainly one, allowing AMD to provide a much better product. Unlike those days though, there are more than just two players in the ARM SoC space, and Qualcomm has been under some relentless competition (always the best kind) from Samsung at the high end with the Exynos 7420, and on the low end with companies like Mediatek and Rockchip going after the lower margin business.

It’s not fair to blame all of Qualcomm’s woes on one issue, but Qualcomm’s issues began when Apple made the surprise move to 64-bit. On the 32-bit side, Qualcomm had been using custom designed ARM cores, with the last evolution of that being the Krait 450 core in the Snapdragon 805. Krait performed well, but with the move to 64-bit, suddenly the industry felt that the need to check the 64-bit box on the spec sheet in order to compete. Since Qualcomm was not ready with their 64-bit custom core, they had to turn to the standard ARM designs with the A53 and A57 powering their 64-bit lineup. As a result, this affected their market differentiation and performance at the high end.

Qualcomm will finally be moving to FinFET with the Snapdragon 820, and with it will be the custom Kyro 64-bit core. This should be available in the latter part of 2015, and available in devices in early 2016.

But that is the future, and today Qualcomm released their Q3 FY 2015 results. Revenue for the company was $5.8 billion, down 14% from the $6.8 billion a year ago. Operating income was down a staggering 40% to $1.2 billion, and net income was down 47% to $1.2 billion. Earnings per share fell 44% to $0.73, with Non-GAAP EPS of $0.99 which actually beat expectations slightly.

| Qualcomm Q3 2015 Financial Results (GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | Sequential Change | Year-Over-Year Change | |

| Revenue (in Billions USD) | $5.8 | $6.9 | $6.8 | -15% | -14% |

| Operating Income (in Billions USD) | $1.2 | $1.3 | $2.1 | -8% | -40% |

| Net Income (in Billions USD) | $1.2 | $1.2 | $2.2 | +12% | -47% |

| Earnings per Share (in USD) | $0.73 | $0.63 | $1.31 | +16% | -44% |

For a company which at one point seemed certain to become the dominant player in the ARM SoC space, these numbers hit pretty hard. Incorporated companies have a fiduciary duty to their shareholders, and Steve Mollenkoft, CEO of Qualcomm, today announced a major restructuring of the company which will see the company shed up to 15% of its workforce. It intends to save $1.1 billion annually through a series of targeted layoffs which will impact their temporary workforce, engineering, and reducing the number of offices. It is also reducing the annual share-based compensation by around $300 million. These cuts are expected to be complete by the end of fiscal year 2016, for a savings of $1.4 billion annually.

| Qualcomm Q3 2015 Financial Results (Non-GAAP) | |||||

| Q3'2015 | Q2'2015 | Q3'2014 | Sequential Change | Year-Over-Year Change | |

| Revenue (in Billions USD) | $5.8 | $6.9 | $6.8 | -15% | -14% |

| Operating Income (in Billions USD) | $1.7 | $2.7 | $2.4 | -37% | -30% |

| Net Income (in Billions USD) | $1.6 | $2.3 | $2.5 | -31% | -35% |

| Earnings per Share (in USD) | $0.99 | $1.40 | $1.44 | -29% | -31% |

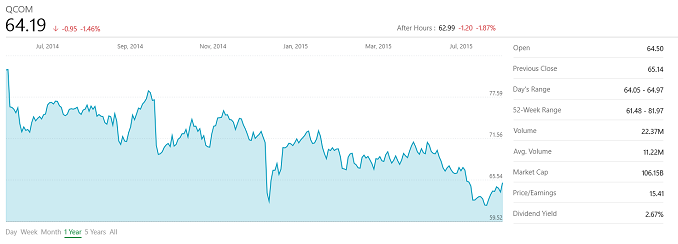

They will also be reviewing their corporate structure, capital return opportunities, and other alternatives with the goal of creating stockholder value. Qualcomm’s shares have fallen in price around 20% in the last year. They also have reaffirmed their commitment to return significant capital to shareholders, with a minimum of 75% of free cash flow being returned through dividends and share repurchases, in addition to the $10 billion stock repurchase program which was already underway. The board has also seen a shakeup, with two new members being added and they intend to appoint one additional independent director to the board. The company executives will also have additional return-based metrics for compensation.

Ultimately there is a lot of pressure on Qualcomm from some of its larger investors to split the company's highly profitable licensing business and their riskier chip development business, and this is something Qualcomm will be evaluating. In good times the chip business contributes significantly to Qualcomm's fortunes, but by its nature it's not as regular or profitable as Qualcomm's licensing efforts, and given the competitive landscape Qualcomm is in, investors are pushing a split as a means of allowing them to only invest in the licensing business and not be exposed to the chip business as well. Qualcomm for their part has stated that they are investigating this option, though whether it actually comes to pass remains to be seen.

All seems pretty rough for Qualcomm, but in the end they were still profitable, although not as profitable as they would like to be. MSM chip shipments were actually flat year-over-year with 225 million SoCs shipped. The initial 64-bit era has not been overly kind to Qualcomm though, and with their custom core being around six months away still, they have some work to do in the interim to avoid a repeat with the next SoC refresh.